Amazon provides dozens of metrics in advertising reports. Most of them don't matter for day-to-day optimization. This guide covers the metrics that actually drive decisions, what they mean, and what benchmarks to target.

The Core Metrics

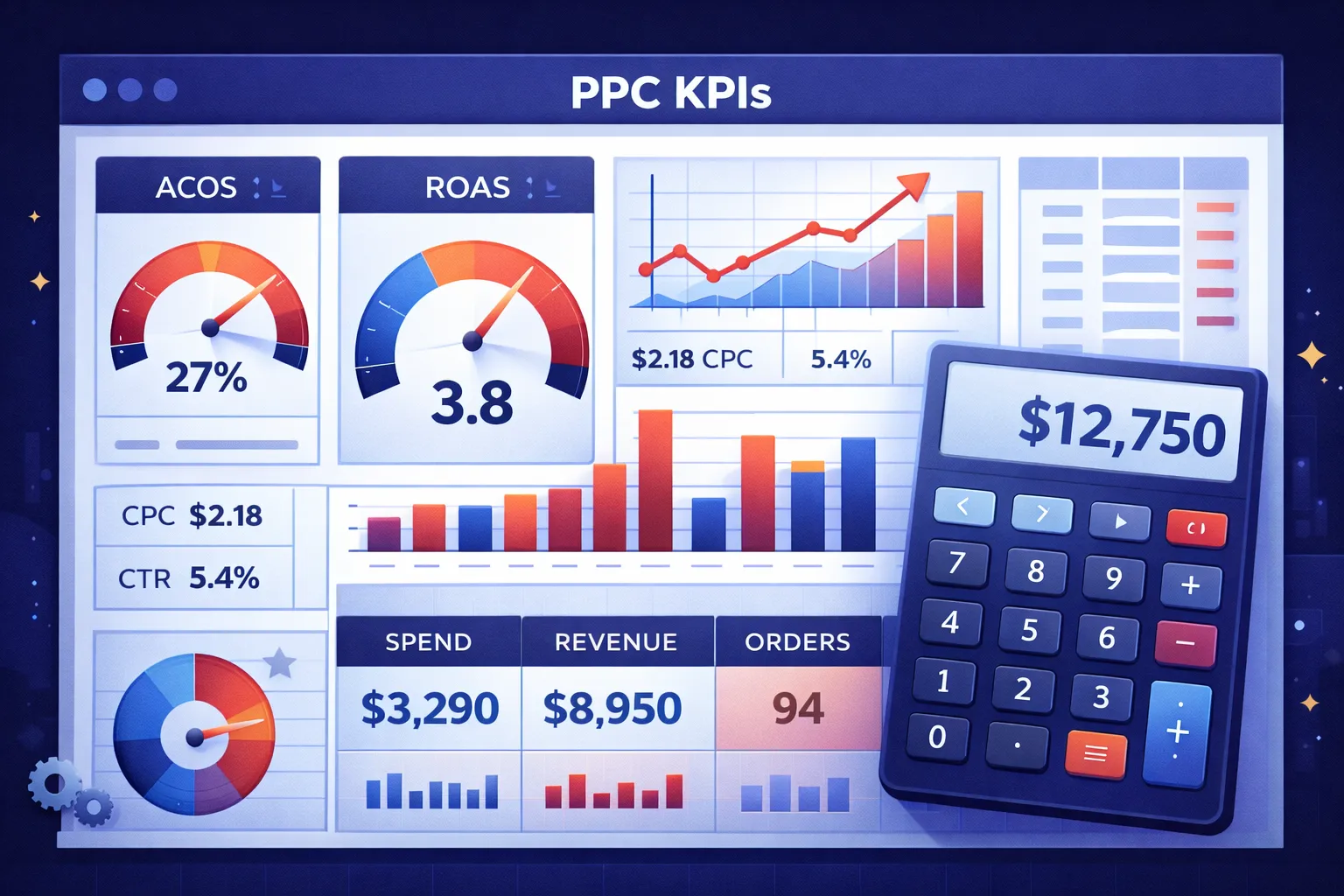

ACoS (Advertising Cost of Sale)

The percentage of ad revenue spent on advertising. The most commonly used Amazon PPC metric.

If you spend $100 on ads and generate $400 in ad-attributed sales, your ACoS is 25%.

ROAS (Return on Ad Spend)

The inverse of ACoS. Shows how much revenue you generate per dollar spent.

A 25% ACoS equals a 4x ROAS. Some advertisers prefer ROAS because higher is better (unlike ACoS where lower is better).

TACoS (Total Advertising Cost of Sale)

Ad spend as a percentage of total revenue (not just ad-attributed revenue). Shows how dependent your business is on advertising.

Healthy TACoS typically ranges from 5-15%. Rising TACoS with flat revenue signals organic sales are declining.

What's a Good ACoS?

The Real Answer

There's no universal "good" ACoS. It depends entirely on your profit margins, goals, and product lifecycle stage. A 50% ACoS might be excellent for a product launch and terrible for a mature product defending market share.

Calculating Your Breakeven ACoS

Your breakeven ACoS equals your profit margin before advertising. Here's how to calculate it:

- Product price: $30.00

- Manufacturing cost: $8.00

- Amazon fees (referral + FBA): $10.00

- Profit before advertising: $12.00

- Breakeven ACoS: $12 ÷ $30 = 40%

At 40% ACoS, you break even on every sale. Below 40%, you're profitable. Above 40%, you're losing money on ad-attributed sales.

Target ACoS by Goal

| Goal | Target ACoS | Rationale |

|---|---|---|

| Maximum Profit | Below breakeven | Every sale contributes to bottom line |

| Aggressive Growth | At or slightly above breakeven | Reinvesting all profit into visibility |

| Product Launch | 50-100%+ temporarily | Buying reviews and ranking momentum |

| Liquidation | Very high | Moving inventory regardless of profit |

BSR vs Keyword Ranking

These are frequently confused but measure different things:

Best Seller Rank (BSR)

- Measures sales velocity relative to other products in a category

- Updates hourly based on recent sales

- Lower is better (#1 sells the most)

- Volatile—a few sales can swing rank significantly for low-volume products

Keyword Ranking

- Measures organic position for a specific search term

- Determined by relevance, sales history, conversion rate, and other factors

- More stable than BSR

- Different for every keyword (you might rank #5 for one term and #50 for another)

How to Measure Keyword Ranking

Search the keyword on Amazon and find where your product appears organically (excluding sponsored placements). Tools like Helium 10 or Jungle Scout can track this automatically across many keywords.

Engagement Metrics

CTR (Click-Through Rate)

Typical range: 0.3% - 0.5% for Sponsored Products

Low CTR indicates either poor targeting (wrong audience) or weak creative (main image, price, rating).

CVR (Conversion Rate)

Typical range: 10% - 15% for well-optimized listings

Low CVR with high CTR usually indicates listing problems—the ad is attracting clicks but the detail page isn't converting.

CPC (Cost Per Click)

What you actually pay when someone clicks your ad. This is determined by auction dynamics, not just your bid.

Typical range: $0.50 - $2.00 (varies significantly by category)

Competitive categories like supplements or electronics can exceed $5 per click.

Industry Benchmarks

| Metric | Low | Average | Good |

|---|---|---|---|

| CTR (Sponsored Products) | <0.2% | 0.3-0.4% | >0.5% |

| CVR | <8% | 10-12% | >15% |

| CPC | Varies by category | $0.75-$1.25 | Below category avg |

| ACoS | Depends on margins | 25-35% | Below breakeven |

New-to-Brand Metrics

Available for brands enrolled in Brand Registry, these metrics show customer acquisition:

- New-to-Brand Orders: Orders from customers who haven't purchased from your brand in the past 12 months

- New-to-Brand Sales: Revenue from new-to-brand orders

- % New-to-Brand: Percentage of orders that are new customers

When New-to-Brand Matters

If customer acquisition is a goal, you might accept higher ACoS on campaigns with high new-to-brand percentages. A 50% ACoS with 80% new customers might be more valuable than a 30% ACoS with 20% new customers.

PPC as Percentage of Total Sales

This metric (essentially TACoS expressed differently) indicates advertising dependency:

| PPC % of Sales | Interpretation |

|---|---|

| <20% | Strong organic presence, advertising supplements |

| 20-40% | Balanced—common for competitive categories |

| 40-60% | Heavy advertising dependency |

| >60% | Concerning—organic sales may be too weak |

Watch this metric over time. Rising PPC dependency often signals declining organic ranking or increased competition.

Key Takeaways

- Calculate your breakeven ACoS before setting targets—it's unique to your product

- Use TACoS to monitor overall advertising health, not just campaign-level ACoS

- BSR measures sales velocity; keyword ranking measures organic position

- Low CTR = targeting or creative problem; low CVR = listing problem

- New-to-brand metrics matter if customer acquisition is a priority

Need Help With Your Amazon KPIs?

We help brands understand their metrics and build strategies that drive profitable growth.

Book a Strategy Call